Debt payment formula

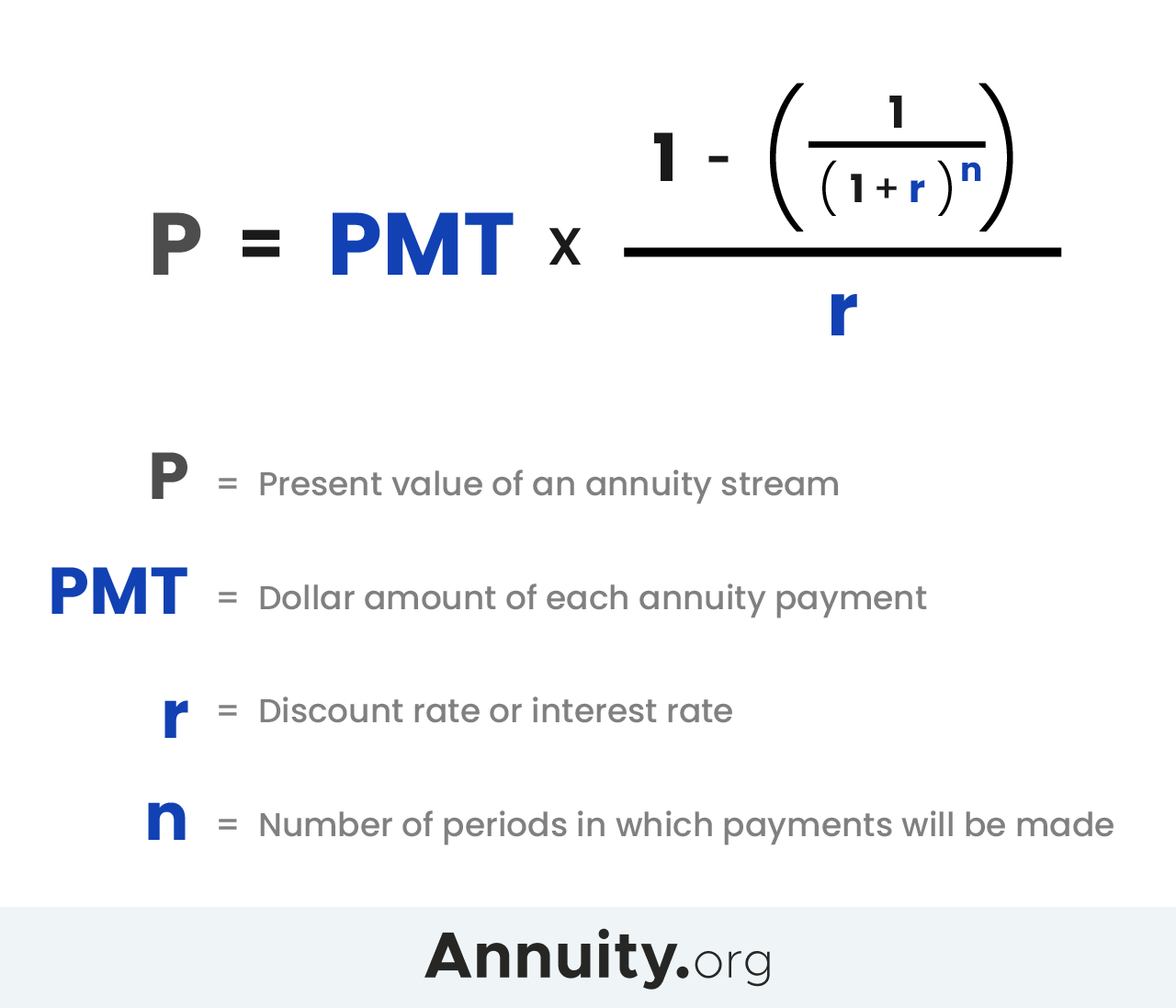

Suppose the company agreed to pay interest at the end of every year and at the end of seven years it will pay back the face value of the bond. Pmt PV x i 1 - 1 1 i n The debt constant is equal to PmtPV whereas the annuity factor is given by PVPmt.

How To Calculate A Debt Constant Double Entry Bookkeeping

C2 A2 CMP PDA.

. Additionally it gives users the most cost-efficient payoff sequence with the option of adding. For residents Get relief for 10K-150000 debt without filing bankruptcy. Apart from this tool you may also be interested in our debt reduction calculator that can.

E2 D1 D2. Tj spent 2600 on his sw credit card To find purchase APR or interest rates go. The back-end debt to income ratio encompasses all other recurring debt payments such as car loans credit card payments education loans etc.

The calculator below estimates the amount of time required to pay back one or more debts. The relationship between the debt constant and the annuity. D1 C1 CDB.

Our Certified Debt Counselors Help You Achieve Financial Freedom. Lenders use a debt to income ratio of 2836. Ad 10000-125000 Debt See If You Qualify for Debt Relief Without a Loan.

Get a Free Evaluation to Find the Best Solution for You. As a result applicants will be expected to go through the full underwriting process that includes checking credit histories. B2 A1 A2.

Apply for a Consultation. AFCC BBB A Accredited. The opening balance in our debt schedule is equal to.

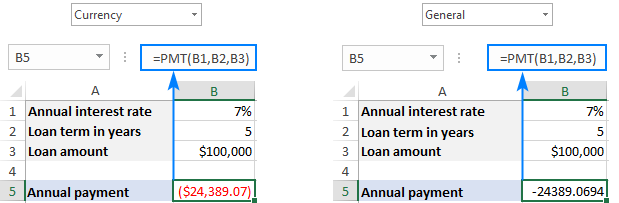

Private student loans mostly originate from banks and loan companies. Ad One Low Monthly Payment. P Initial principal or loan amount in this example 10000 r Interest rate per period in our example thats 75 divided by 12.

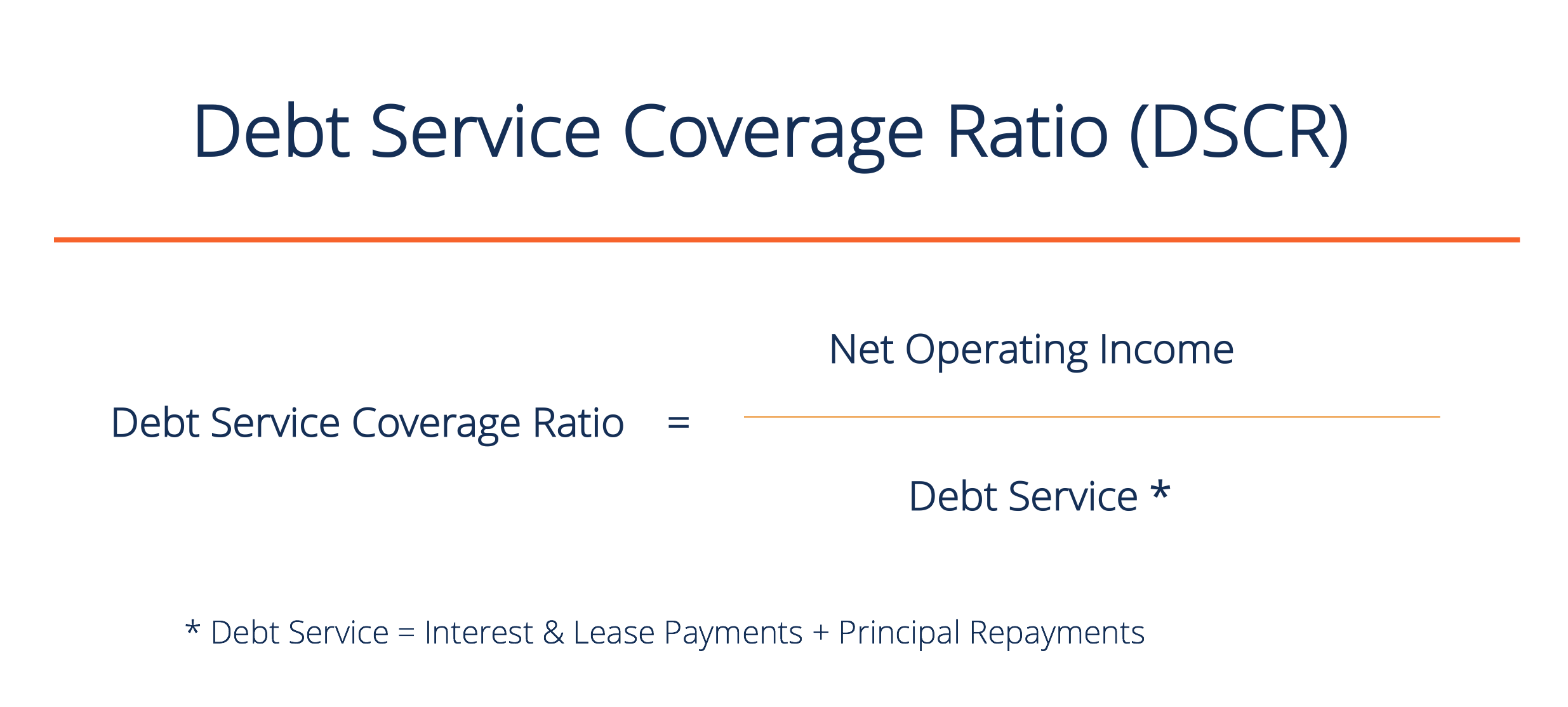

NPERRatepmtpv To calculate cumulative interest payment for period n1 through n2. Consider two scenarios with a monthly debt payment of 1500 each. A DSCR of 2857 is a good DSCR for granting of a loan to the real estate developer.

Talk to a Specialist Today. Assume that the balance due is 5400 at a 17 annual interest rate. However the gross monthly income for scenario one is 3000 while the gross monthly income for scenario.

O PAi1-1ti -N Aamount iinterest rate N of periods month week yr o EX. Figure out the monthly payments to pay off a credit card debt. DSCR 200000 70000.

C1 A1 CMP. Get a Free Debt Consultation. D2 C2 CDB.

The term Net debt refers to a liquidity metric that is useful in assessing the potential of a company to pay all of its debts in case they are immediately due. In such a case the annual debt. Nothing else will be purchased on the card while the debt.

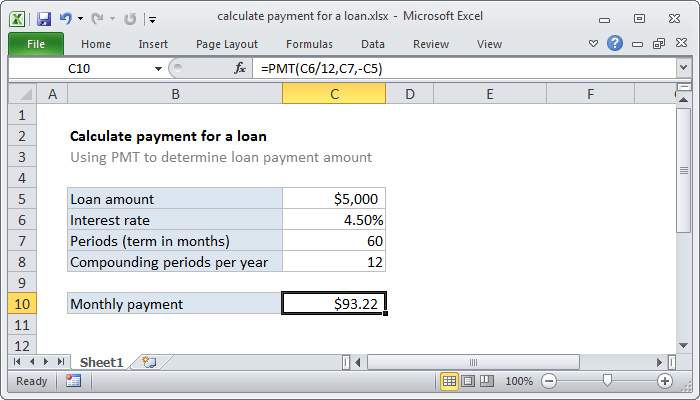

In this example we assume the debt to be 5000000 the payment term to be 5 years and the interest rate to be 45. Now if the developer has also lease payments to pay then of 5000. To calculate a number of payment below formula is used.

A Payment amount per period.

Coupon Rate Formula Calculator Excel Template

Excel Pmt Function With Formula Examples

Calculate The Debt Service Coverage Ratio Examples With Solutions

Loan Payment Formula With Calculator

Time To Pay Formula Youtube

Present Value Of An Annuity How To Calculate Examples

Excel Pmt Function With Formula Examples

Cost Of Debt Definition Formula Calculation Example

How To Use The Excel Pmt Function Exceljet

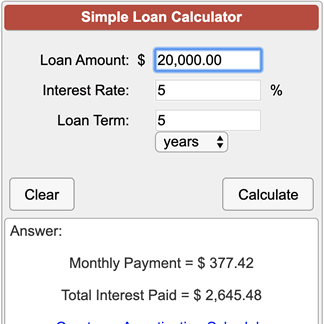

Simple Loan Calculator

Excel Formula Calculate Payment For A Loan Exceljet

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is An Amortization Schedule How To Calculate With Formula

Excel Pmt Function With Formula Examples

How To Calculate Your Monthly Mortgage Payment Given The Principal Interest Rate Loan Period Youtube

Excel Pmt Function With Formula Examples

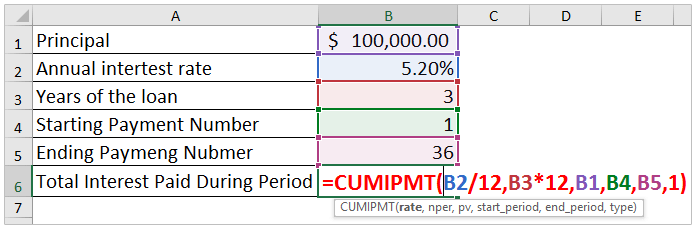

How To Calculate Total Interest Paid On A Loan In Excel

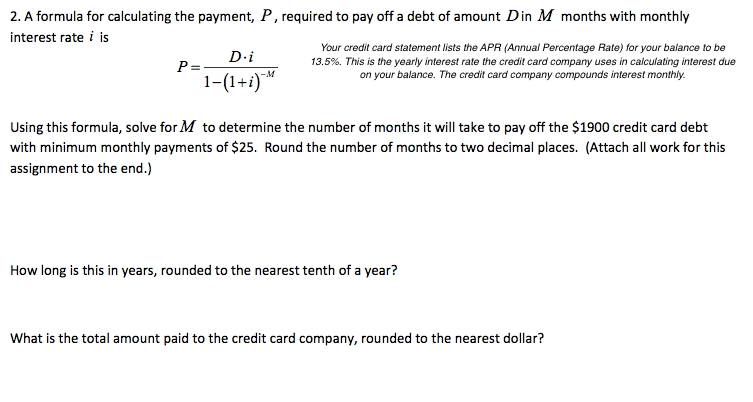

Solved 2 A Formula For Calculating The Payment P Required Chegg Com